For those who follow financial news, major economic data releases like the Consumer Price Index (CPI) and the Non-Farm Payrolls (NFP) report are well-known for their ability to cause significant volatility in currency markets.

However, in the increasingly data-driven world of 2025, professional forex traders are paying closer attention to a more obscure, but highly insightful, report from the U.S. Bureau of Labor Statistics: the Job Openings and Labor Turnover Survey, or JOLTS. While it may not grab the headlines, the JOLTS report provides a crucial, forward-looking view of the health of the U.S. labor market, and its data can offer valuable clues about the future direction of the U.S. Dollar.

What is the JOLTS Report?

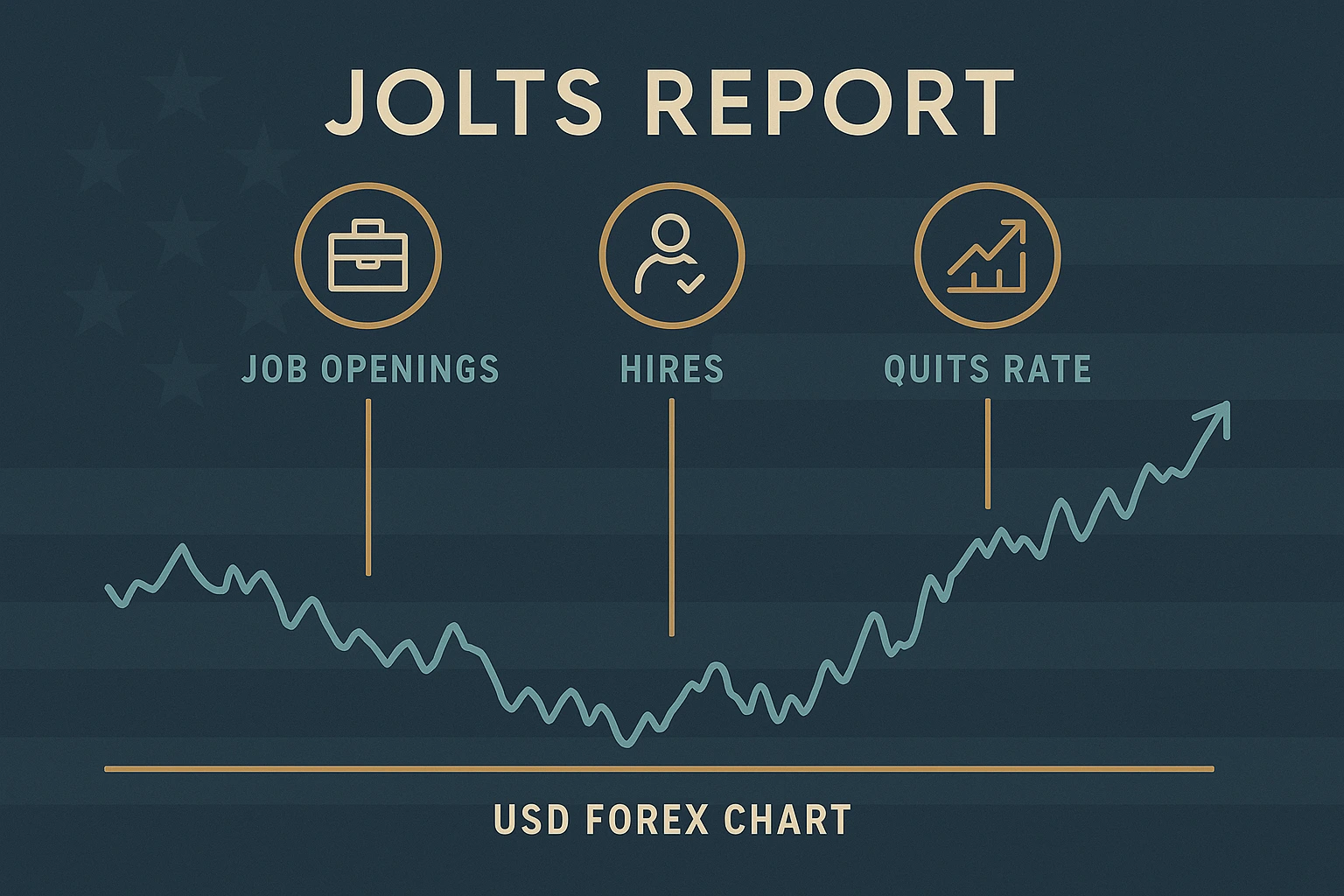

The JOLTS report, released monthly, provides a detailed picture of the dynamism of the U.S. labor market. Unlike the more famous NFP report, which is a snapshot of how many jobs were created or lost in the previous month, the JOLTS report measures the underlying flows within the job market. Its key components include:

- Job Openings: The total number of unfilled jobs at the end of the month. This is a key measure of the unmet demand for labor in the economy.

- Hires: The total number of new employees added to payrolls during the month.

- Separations: The total number of employees who were separated from their jobs during the month. This is further broken down into “quits” (voluntary separations), “layoffs and discharges” (involuntary separations), and “other separations.”

Why the “Quits Rate” Matters So Much

While all the components of the JOLTS report are useful, the “quits rate”, the number of people voluntarily leaving their jobs as a percentage of total employment, has become a particularly important indicator for the Federal Reserve and for forex traders. A high quits rate is a sign of a strong and confident labor market. It indicates that workers are optimistic about their ability to find a new, better-paying job.

This worker confidence often leads to wage growth, as companies have to compete for talent. Since wage growth is a key driver of inflation, a high quits rate is seen as a “hawkish” inflationary signal. This can lead the Federal Reserve to maintain a higher interest rate policy to keep inflation in check. A hawkish Fed is generally bullish for the U.S. Dollar, as it attracts foreign capital seeking higher yields.

Therefore, a surprisingly high quits rate in the JOLTS report can cause the U.S. Dollar to strengthen against other currencies. This deep dive into the nuances of economic data is a core part of professional Fundamental Analysis.

Job Openings and the Labor Market Imbalance

The job openings number is another critical piece of the puzzle. A high number of job openings relative to the number of unemployed people indicates a tight labor market where there is a significant imbalance between the demand for labor and the supply of workers. This imbalance also puts upward pressure on wages and is therefore seen as an inflationary signal by the Federal Reserve.

For much of the post-pandemic era, the extremely high number of job openings in the JOLTS report was a key reason why the Fed pursued an aggressive rate-hiking cycle, which was a major factor in the U.S. Dollar’s strength. A sudden drop in job openings, on the other hand, could be an early warning sign of a cooling economy, which might lead the Fed to consider cutting rates, a move that would be bearish for the dollar.

How This Affects the Average Currency Converter User

For the average person using a price converter to plan a trip or send money abroad, the intricacies of the JOLTS report might seem remote. However, the data in this report is a key input for the large financial institutions and algorithmic trading firms that dominate the forex markets.

Their reaction to the JOLTS data is what causes the exchange rates to move. By understanding what these professional players are looking at, an individual can gain a much better understanding of the forces that are driving the long-term trends in currency values. This knowledge can help in making more informed decisions about when to convert currency.

For those looking to trade directly on these data releases, using a platform like the YWO trading platform, which offers fast execution and a stable environment, is crucial for navigating the potential volatility.

Jay is a data analyst and research writer. He works in the field of finance, decentralised finance, stock market, and business. He used to work as a finance consultant in Silicon Vally, after which he decided to reduce his stress levels and go on a less-thriving way. His favourite graphic novel is Hellblazer.