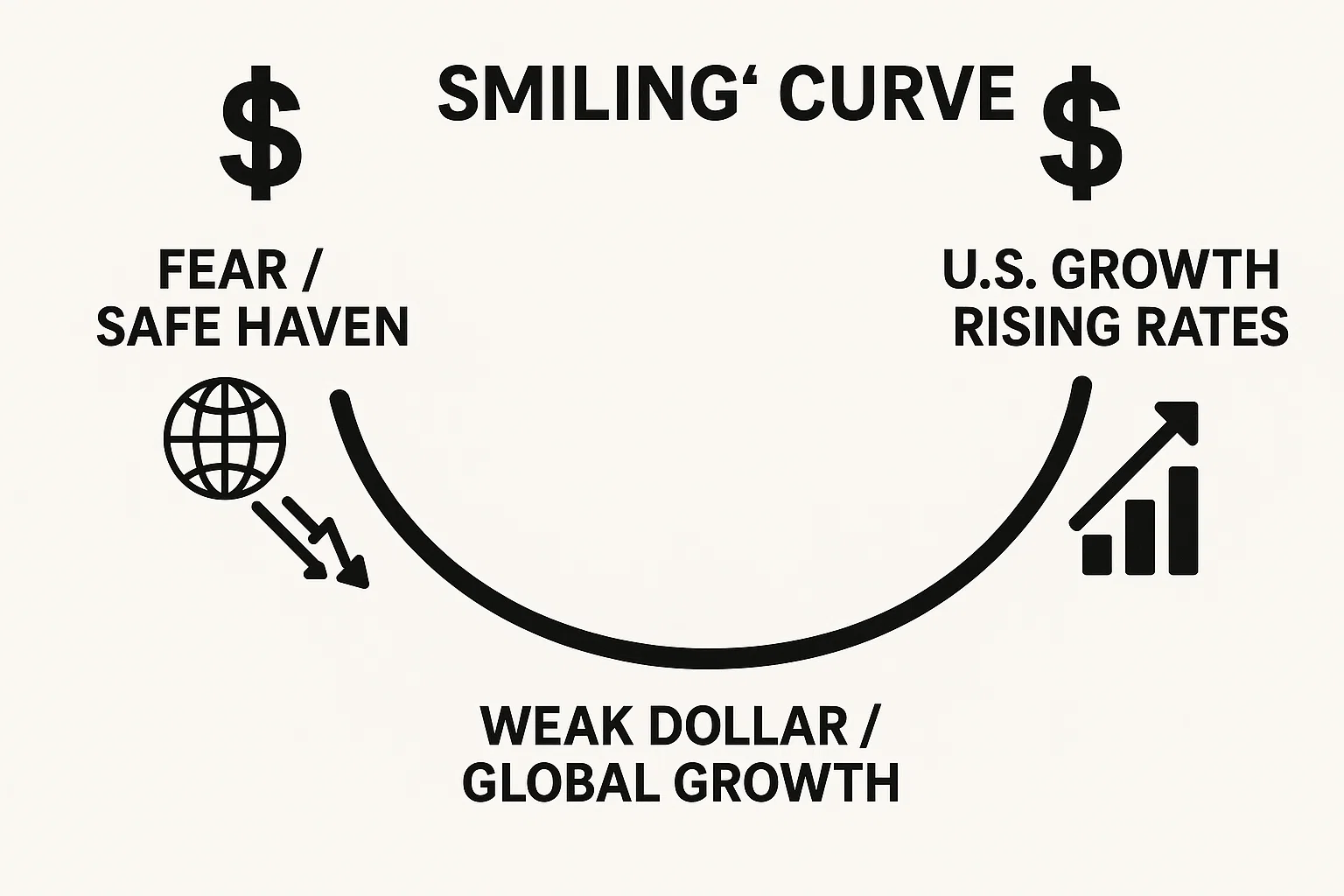

Currency markets can be confusing. Sometimes the U.S. Dollar (USD) strengthens when the U.S. economy is booming. Other times, it strengthens when the global economy is crashing. It seems contradictory: how can a currency go up on both good news and bad news? This phenomenon is explained by a famous framework in forex economics known as the “Dollar Smile” Theory, developed by Stephen Jen. Understanding this theory is essential for anyone trying to predict exchange rates, as it explains the unique role of the USD as both a growth currency and a safe haven.

The Left Side of the Smile: Fear and Safety

Imagine a smile shape (a U-curve). The left side of the smile represents a global recession or financial crisis. When investors are scared, they flee risky assets (like stocks or emerging market currencies) and run to the safest, most liquid asset on the planet: U.S. Treasury bonds. To buy these bonds, they need U.S. Dollars. This massive demand for safety drives the value of the Dollar up, even if the U.S. economy itself is in a recession. The Dollar is the world’s “safe haven.”

The Right Side of the Smile: Growth and Yield

The right side of the smile represents a period of strong U.S. economic growth. When the U.S. economy is outperforming the rest of the world, the Federal Reserve usually raises interest rates to prevent overheating. Higher interest rates attract foreign capital seeking a better return on investment. Global investors sell their Euros or Yen to buy Dollars and invest in booming U.S. assets. Thus, the Dollar strengthens on the back of optimism and growth.

The Bottom of the Smile: The Weak Dollar

The bottom, or middle part of the smile, represents a “Goldilocks” scenario where the U.S. economy is muddling along with mediocre growth, but the rest of the world (like Emerging Markets, Europe, or China) is growing faster. In this environment, investors feel safe enough to sell their defensive Dollars and chase higher returns in riskier, faster-growing markets abroad. Capital flows out of the USA, and the Dollar weakens.

Where Are We Now?

Using the Dollar Smile theory allows users to contextualize the rates they see on a price converter. Are we in a period of fear (Left Side)? Are we in a period of U.S. exceptionalism (Right Side)? Or are we in a period of global synchronized growth (Bottom)? This framework helps explain why the exchange rate is moving the way it is. It is a key concept in Fundamental Analysis.

For those looking to actively trade these macro regimes, accessing the deep liquidity of the forex market requires a robust broker. The YWO trading platform allows traders to take positions on the U.S. Dollar against a basket of global currencies, enabling them to profit from whichever side of the smile the global economy is currently traversing.

Jay is a data analyst and research writer. He works in the field of finance, decentralised finance, stock market, and business. He used to work as a finance consultant in Silicon Vally, after which he decided to reduce his stress levels and go on a less-thriving way. His favourite graphic novel is Hellblazer.